M3 End of Year Checklist: Operations, Finance and IT

Jun 03 2015

Financial year end can be stressful. In this informative video, one of our Infor M3 Finance Gurus, Lars Nilsson, summarises the operational & financial M3 settings to review or update, with some important tips, notes and cautions.

The video link is at the end of the article – after the quick summary below.

End of Financial Year Checklist

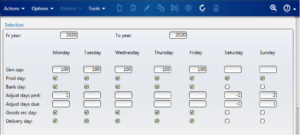

CRS900 System Calendar (required)

The system calendar is required at both company and division levels. Ensure dates exist for a minimum of five years into the future and check the M3 defaults for the standard working week.

Take particular notice of the ‘Adjust days payment’ and ‘Adjust days due’ fields, as they influence the calculation of invoice due dates in A/P & A/R.

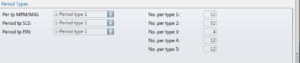

CRS910 System Periods (required)

System periods are required at both company and division levels. The period type used for financial modules is normally defined to contain 12 periods, while planning and production commonly has a 52 week period structure. Ensure system periods are defined for five years into the future for all modules.

Tip: On the division record MNS100/F, period types are connected to the M3 modules. The definition of the number of periods within each period type is to the right.

CRS400 Journal Number Series (required)

Journal numbers are defined either at the company or the division level.

CRS410 Voucher Number Series (optional)

Like journal numbers, voucher numbers are defined at the company or the division level. Voucher numbers commence at an effective from date, therefore it is not necessary to create a new series for each financial year.

MFS165 Internal Invoice Series (required)

Invoice numbers are defined at the division level. Ensure you have a new series for each type of invoice.

CRS165 Number Series (optional)

While the number series is not technically a year end checklist item, it is a good discipline to review your number sequences on a regular basis. You should ensure the remaining available numbers for each series is sufficient and not putting you at risk of halting any critical processes within your business.

GLS985 Open/close financial year/Activate periods (optional, if using M3 V10 (BE14) or later)

Ensure the new financial year is active.

Caution: You should exercise extreme caution when closing financial years via this program. A closed financial year cannot be re-opened.

Annual Run Programs (Optional, but highly recommended)

GLS905 G/L Balance File Annual Run

ARS910 A/R Balance File Annual Run

APS910 A/P Balance File Annual Run

CAS905 Order Costing Balance File Annual Run

The purpose of the annual run programs is to create a period 00 record within the respective balance files. Period 00 holds the opening balance for the new year. The benefit of having period 00 in a balance file is to improve performance during reporting and on-line inquiries. Any calculation of a balance can begin from the last period 00 record, instead of referencing every historical transaction within the ledger.

It is recommended to run the annual run programs, once the June financial period is finalised. If changes are made in the ledgers that affect the opening balances after the program has been run, then these changes will automatically update period 00.

Tip: Don’t forget to transfer your yearly P&L result to retained earnings. You can do this with a simple journal between a P&L transfer account and retained earnings. Alternatively, you can use the GLS995 program. Without performing this task, your trial balance for July will be unbalanced by the previous year’s profit/loss result.

FAS190 Fixed Assets Annual Run (required, if using fixed assets)

The purpose of the annual run program for fixed assets is to roll YTD depreciation values into accumulated depreciation. The program also has options to calculate Replacement and Insurance values.

The program must be run after the last depreciation update has been processed for the year and prior to performing depreciation updates and selling or scrapping assets in the new financial year.

Other year-dependent programs you may be using:

GLS216 Templates for GLS215 (if they contain reference to the year’s budget)

APS095 Supplier Recurring Payments

DRS045 Time Zones

PDS033 Shift Pattern

CRS515 Work Schedule

CRS510 Employee Connect Calendar

CRS520 Employee Create Calendar

PDS015 Work Centre Capacity

PDS960 Create Work Centre Capacity

DPS001/2 Distribution Days

RPS080/1 Point of Time Table

Watch the Video

To watch the video click here

If you would like more help with your Infor M3 finance module contact us today

FOLLOW

FOLLOW