Using Price Elasticity to Maximise Profit

Sep 03 2012

Getting the perfect price point to optimise overall profit is key to many businesses – especially those in the retail sector. It’s a complex science which impacts us all, whether as business managers or consumers.

As anyone in supply-chain business knows, there is an endless series of constraints, which needs to be considered when planning on getting goods to market – bottlenecks, capacity, resourcing, demand, supply – the list is endless. So how then, do businesses delivering to a highly responsive market such as retail, factor in price elasticity as well?

Economists define price elasticity as the responsiveness of consumers to changing prices – when the price of soft-drink goes down, people buy more. Businesses in the retail sector often run price promotions to drive demand and increase sales and profit. However, sometimes businesses might run a promotion to push existing or expected (planned) surplus stock. This might be due to poor sales performance, production process, expiration, or maybe even a change of season. We can see this as a sales opportunity and in order to determine the right price points, those businesses need to understand a couple of things – firstly, how will consumers respond to changing prices (price elasticity), and secondly, when you incorporate price elasticity into planning what will be the impact on the overall profit.

When to factor price elasticity into your planning

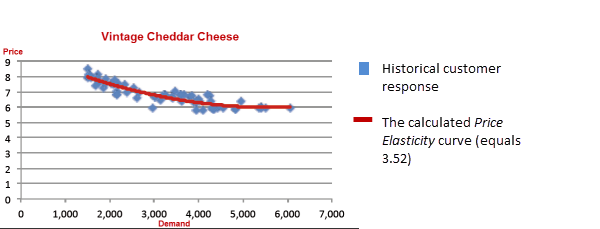

Not all products have a price elasticity that is useful for planners – it’s important to be able to reliably predict the responsiveness of consumers to changing prices. To do this, you need to look at past performance, and determine whether a static pattern emerges. In the graph below you can see that the “Price Elasticity curve” (in red) is very close to the historical consumer reaction to price changes (in blue). So what does all this mean? It means that the price elasticity is reliable, so the planner can then use price elasticity to predict how many vintage cheese consumers will buy at different price points. The key take-away here is that price elasticity can be an invaluable consideration for planners – when it’s stable.

Factor in other constraints to maximise profit

Price elasticity is just one factor, however, in making the right decision to ensure overall maximum profit. There are several other considerations that need to be thought about, to ensure that decisions right across the planning spectrum are factored in.

For example, going back to our vintage cheese scenario, imagine that the cheese producer knows that in two months they will have a large surplus stock of expired cheese. A simplistic decision would be to continue selling the cheese at the current price, because they know that this gives them good profit margins, and then having a big cheese sale in two months time to try and get rid of the stock. However, this doesn’t consider constraints that may be imposed by other parts of the supply chain.

Plan using the bigger picture

If the cheese producer had clear visibility into their supply chain, and understood where all the constraints lay, understood the price elasticity for the cheese, as well as factoring in other intelligence about their business, they might make a much more sophisticated decision which will result in a much better overall profit. In a simple example, they may know that in three weeks time, there is going to be surplus capacity in the packaging centre, and also that in two months time the distribution centre is expected to be running at near full capacity (when the annual cheese festival is on). With this knowledge, they could come up with a plan for the whole two months, which might take advantage of running a promotion in three weeks to utilise the surplus capacity, and then using variable pricing (based on what they know about price elasticity) throughout the rest of the time to ensure that all stock was cleared before the expected bottle-neck in two months’ time.

Utilising price elasticity is a key way for planners to increase profit, but it is more important to understand it as part of the bigger supply-chain picture to ensure that you consider all constraints and get the absolute maximum profit for the business as a whole.

Note: If you want to know more about the economic theory behind price elasticity, there’s a great informative video at this non-for-profit education site, the Khan Academy View Video

FOLLOW

FOLLOW